Financing an engagement ring isn’t about spending more than you can afford; it’s about breaking a significant purchase down into payments that actually fit your life. Options like in-store financing, 0% APR credit cards, personal loans, and even Buy Now Pay Later (BNPL) services are all on the table, each offering a different way to manage the cost.

Why Engagement Ring Financing Is a Smart Financial Tool

Let’s be honest—finding the perfect engagement ring is an incredible moment, but that price tag can feel like a gut punch. This guide is here to demystify financing and show you how it can be a savvy financial tool, not just a last resort.

Smart couples today are using financing to get the dream ring now without wiping out their savings. It's a bridge that lets you celebrate this milestone while keeping your financial goals on track.

The Shift from Cash to Credit

Not long ago, most couples saved up and paid for a ring in cash. That's changed. As the cost of a beautiful ring has climbed, financing has become a practical and popular choice.

Consider the numbers: The Knot’s 2024 data puts the average engagement ring cost at $5,200. In high-cost areas like New York City or states like California, other industry surveys show that average creeping closer to $10,000. At those prices, a payment plan just makes sense.

Financing isn't about going into debt for a ring. It's about smart cash flow management. You preserve your savings for a down payment, a wedding, or an emergency fund while still getting to celebrate this huge life event.

Of course, before making any major purchase, it's always a good idea to focus on getting your financial house in order. This guide will walk you through the most common paths—like in-store offers, credit cards, and personal loans—so you can decide which one aligns best with your budget and goals.

Our goal is to swap that financial anxiety for confidence. We'll break down:

- The most common financing methods and exactly how they work.

- The real-world pros and cons you need to know for each option.

- How to figure out the best plan for your budget.

- A few tips to make sure your application is successful.

By the end, you'll have the clarity you need to make a great decision. For more essential background, our comprehensive guide to buying engagement rings is the perfect place to start. Let us be your partner in this exciting journey.

Your Primary Engagement Ring Financing Options Explained

Jumping into the world of engagement ring financing options can feel like trying to learn a new language. You’ll hear terms like APR, deferred interest, and promotional periods, but what does that all mean for your bank account? Let’s translate the jargon.

We're going to break down the four most common ways to finance the perfect ring. Think of them as different tools in your financial toolkit, each designed for a specific job. Understanding how they work is the first step toward making a smart, confident decision.

In-Store Jeweler Financing

This is the jeweler’s own payment plan, built specifically for their customers. It’s a dedicated line of credit offered right in the store, usually through a partner bank. The biggest draw? Pure convenience. You can pick out the ring and sort out the financing all in one go.

The process is usually fast and simple. You fill out an application at the counter or online and often get an answer in minutes, which means you don't have to secure a loan before you even start shopping.

But that convenience can come with a catch. While many jewelers offer incredible promotional deals like 0% interest, the standard rates that kick in afterward can be steep—sometimes climbing over 25%. It's vital to have a game plan to pay off the ring before that promo window shuts. Some jewelers also have special plans if your credit isn't perfect. If you're looking into different approval needs, you can learn more about how no credit check jewelry financing works.

- Pros: Unbeatable convenience, tempting 0% APR offers, and a fast approval process.

- Cons: High interest rates once the promotional period ends and sometimes less flexible terms than a personal loan.

0% APR Introductory Credit Cards

A 0% APR credit card can be a fantastic tool if you use it right. These cards give you a promotional window, usually between 12 and 21 months, where you pay zero interest on new purchases. That means every single dollar you pay goes straight to paying down the ring.

It’s basically an interest-free loan for a year or more. If you have good to excellent credit, this is often one of the most budget-friendly engagement ring financing options out there. Credit cards are a popular choice, and it pays to compare rewards and cashback credit cards to find one that might even earn you points or money back on such a big purchase.

The risk shows up when that introductory period ends. If there’s still a balance, it gets hit with the card's standard, and often very high, interest rate. Even worse, some cards use "deferred interest," meaning if you don't clear the balance in time, they charge you all the interest that would have built up from day one.

A 0% APR card is a fantastic deal if you are disciplined enough to pay off the ring before the promotional period ends. It becomes a very expensive loan if you don't.

Personal Loans from Banks or Credit Unions

A personal loan is probably the most straightforward path. You borrow a set amount of cash from a bank, credit union, or online lender and pay it back in fixed monthly installments over a set time, typically two to five years. The interest rate is locked in, so your payment never changes.

That predictability is a huge plus. You know exactly what you owe each month and exactly when the ring will be paid off. There are no promotional periods to watch or surprise rate hikes like you might see with a credit card. For borrowers with strong credit, interest rates on personal loans are usually lower than standard credit card rates.

The application is a bit more involved than what you'd do in-store. It requires a formal application, proof of income, and a hard credit check, which can knock your credit score down a few points temporarily. But for many, the stability and clear finish line make it a responsible choice.

Buy Now Pay Later Services

Services like Affirm, Klarna, and Afterpay have exploded in popularity for everything from sneakers to fine jewelry. These "Buy Now, Pay Later" (BNPL) platforms let you split the ring's cost into a few fixed payments, often four installments over six weeks, usually with no interest.

For bigger buys, some BNPL companies offer longer-term plans that work more like a traditional loan. You might see terms up to 36 months with interest rates that depend on your credit. The main appeal is how simple and quick it is—approval is often instant and may only require a soft credit check that won't ding your credit score.

Just be sure to read the fine print. While the classic "Pay in 4" model is often interest-free, the longer-term plans can carry interest rates similar to credit cards. It's crucial to know if you'll be paying interest and what the late fees look like if you happen to miss a payment.

Comparing Top Engagement Ring Financing Methods

This table breaks down the key features of the most popular financing options to help you decide which path is right for your budget and credit profile.

| Financing Method | Typical APR Range | Common Term Length | Credit Score Impact | Best For |

|---|---|---|---|---|

| In-Store Financing | 0% promo, then 20%-30% | 6-36 months | Hard inquiry | Convenience and immediate 0% APR offers |

| 0% APR Credit Card | 0% promo, then 18%-28% | 12-21 months | Hard inquiry | Disciplined borrowers with good credit |

| Personal Loan | 6%-25% (fixed) | 2-5 years | Hard inquiry | Predictable payments and lower fixed rates |

| Buy Now, Pay Later | 0% (short-term) or 10%-30% | 6 weeks to 36 months | Soft or hard inquiry | Quick approval and simple, interest-free installments |

Ultimately, the best choice depends on your financial discipline, credit score, and how quickly you can realistically pay off the balance. Each option has its place, so weigh the pros and cons carefully.

Exploring Alternative Paths to Your Perfect Ring

While mainstream financing options like credit cards and personal loans work for many, they aren't the only way to get your dream ring. Sometimes, the smartest move is the one less traveled.

Let's look at a few powerful strategies that go beyond a simple loan application, especially if you have unique financial goals or want to avoid traditional debt.

The Classic Layaway Plan: A Patient Approach

Before "instant credit" was even a thing, layaway was the go-to for big purchases. It’s wonderfully simple: you pick out the ring, the jeweler holds it for you, and you make steady payments over time. Once it's paid off, it's yours.

Think of it as reserving your ring and paying it down without interest or a credit check. This makes it a fantastic option for a few key situations:

- Protecting Your Credit: If your credit score is a work in progress, layaway lets you lock in the ring you want without a hard inquiry hitting your report.

- Forced Savings: It creates a disciplined payment plan. You commit to a schedule, making sure the ring is paid for responsibly without racking up debt.

The only real downside is you have to wait to get the ring. But if your goal is to avoid interest and debt completely, it's a straightforward, risk-free strategy.

Using Assets: Secured Loans and HELOCs

If you own assets like property or investments, you can leverage them to get much better loan terms. Unlike an unsecured personal loan, a secured loan is backed by collateral. This dramatically lowers the lender's risk, which means a lower interest rate for you.

Two common ways to do this are:

- Secured Personal Loan: You can use a savings account, a vehicle, or other valuable property as collateral to get a loan with a very favorable APR.

- Home Equity Line of Credit (HELOC): This lets you borrow against the equity you've built in your home. It works a lot like a credit card but with a significantly lower interest rate.

A Word of Caution: The low rates are tempting, but the stakes are high. If you default on a secured loan or HELOC, the lender can seize the asset you put up as collateral. That means you could lose your savings or even your home. Only go down this path if you are 100% confident you can repay the debt.

A Modern Partnership: Sharing the Cost

One of the biggest shifts in the engagement ring world is the move toward financial teamwork. The old tradition of one partner shouldering the entire cost is fading fast as more couples build their finances together from day one.

Recent surveys show this is a major trend, with nearly 70% of women saying they are willing to help pay for their engagement ring. As couples plan their futures jointly, it only makes sense that this major purchase becomes a shared goal. You can read more about how couples are splitting ring costs.

This can look a few different ways:

- Splitting the total cost 50/50.

- One partner buys the diamond, the other pays for the setting.

- Applying for financing together as co-applicants.

Tackling the expense together doesn't just lighten the financial load—it sets a powerful precedent for open financial communication in your marriage. It's one of the first big decisions you'll make as a team.

How to Choose the Right Financing Path for You

Okay, you've seen all the ways you can finance an engagement ring. Now it's time to figure out which one actually makes sense for you. This isn't about finding a magic formula; it's about picking the strategy that fits your financial life without turning this symbol of commitment into a source of stress.

Think of this as a quick, honest financial health check. By getting real about where you stand and what each option truly costs, you can make a smart decision you'll feel good about for years to come.

Assess Your Financial Foundation

Before you even think about applications, you have to look at your own books. Seriously, don't skip this. It's the most critical part of the whole process.

Zero in on these three things:

- Your Credit Score: This is your golden ticket. A score of 720 or higher is what opens the door to the best deals, especially those 0% APR credit cards. If your score is a bit lower, don't worry—options like in-store financing or layaway are often much more accessible.

- Your Current Savings: How much cash do you have ready to go that isn't for emergencies? A solid savings account lets you make a bigger down payment. That means you finance less, which almost always means smaller monthly payments and less interest paid.

- Your Monthly Budget: Take a hard look at your income versus your expenses. How much can you comfortably set aside each month for the ring without feeling the squeeze? That number is your reality check—it dictates what a manageable payment plan looks like for you.

Getting a clear picture here will instantly narrow down your choices and make the decision a whole lot simpler.

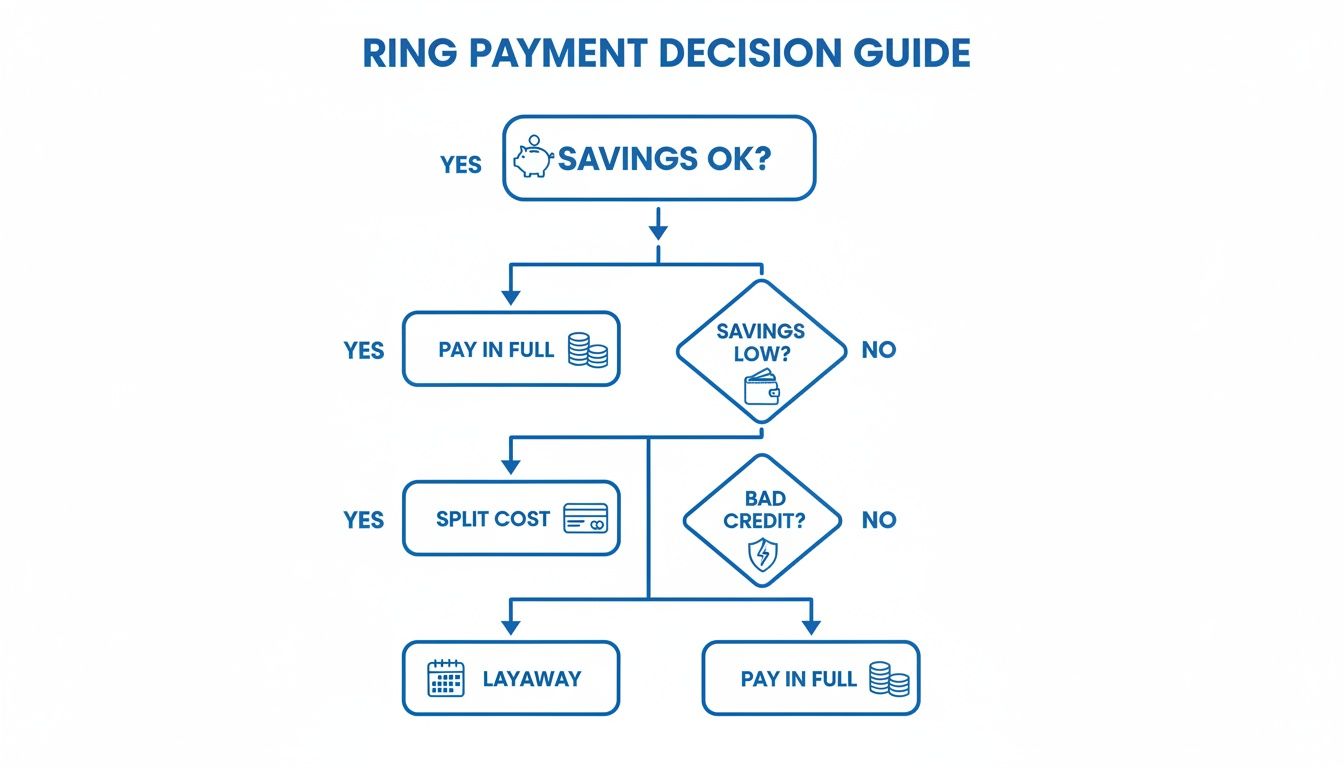

This flowchart shows how your savings and credit naturally point you toward the most logical path, whether that’s paying upfront or finding a payment plan that works.

Compare the Total Cost, Not Just the Monthly Payment

A low monthly payment looks great on paper, but it's often a Trojan horse for a much higher total cost. Stretching a loan over a longer term might feel easier each month, but you'll get hammered with interest over time.

Your goal is the lowest total cost, not just the lowest monthly payment. A higher monthly payment over a shorter term will almost always save you hundreds, if not thousands, of dollars in interest.

Let's break it down with a real-world example for a $6,000 ring.

| Financing Option | APR | Term | Monthly Payment | Total Interest Paid | Total Cost |

|---|---|---|---|---|---|

| 0% APR Credit Card | 0% | 18 Months | ~$333 | $0 | $6,000 |

| Personal Loan | 10% | 36 Months | ~$194 | $984 | $6,984 |

| Store Financing | 25% | 36 Months | ~$239 | $2,604 | $8,604 |

See that? The "easy" store financing ends up costing $2,604 more than if you had used the 0% APR card and paid it off. Always, always run the numbers to find the full cost before you sign anything.

Always Read the Fine Print

Financing agreements aren't just paperwork; they're legally binding contracts written to protect the lender. Your job is to read every line to protect yourself from the "gotchas" that can turn a great deal sour.

Keep an eye out for these landmines:

- Deferred Interest: This is the big one, especially with 0% APR deals. If you don't pay off every single penny before the promotional period ends, they can hit you with all the interest you would have paid from day one. It's a brutal penalty.

- Prepayment Penalties: Believe it or not, some loans charge you a fee for paying them off early. Make sure you have the freedom to pay it down faster without getting dinged.

- Late Fees and APR Hikes: Know exactly what happens if you miss a payment. It usually triggers a hefty fee and can void your promotional rate, causing your APR to skyrocket.

The push for financing isn't going away. Flexible payment options are expected to become even more vital through 2025–2027 as consumers navigate economic shifts. Retailers are leaning heavily on installment plans to help buyers manage large purchases, which is a must in luxury hubs like New York where the average ring spend can top $9,000. To get a deeper dive into this trend, you can read the full market outlook on Fruchtman Marketing's site. All of this just proves why it’s more important than ever to know exactly what you’re signing.

Preparing Your Application and Avoiding Common Pitfalls

Once you've zeroed in on the right financing path for you, it's time to get your application in order. Think of it like preparing for a big presentation—a little prep work now ensures you get the best possible outcome later. This isn't just about shuffling paperwork; it's about presenting yourself as the strongest possible candidate and knowing how to spot the hidden traps in any agreement.

A smooth application process starts with having all your ducks in a row. Lenders need to verify who you are and, more importantly, your ability to pay them back. Being ready with the right documents prevents frustrating delays and shows you’re a serious, organized borrower.

Your Essential Pre-Application Checklist

Before you formally apply for any of the engagement ring financing options we've covered, pull these key documents together. Having them scanned and ready to go can shave days off the approval process, especially if you're working with an online lender.

- Proof of Identity: A clear copy of your driver’s license, passport, or another government-issued photo ID is a must.

- Proof of Income: Lenders need to see stability. Recent pay stubs, W-2s, or tax returns from the last two years will do the trick.

- Proof of Address: A recent utility bill or bank statement showing your name and current address is the standard here.

- Employment Information: Have your employer's name, address, and phone number handy for verification.

Gathering these items beforehand means you can move fast when you find the perfect financing deal.

Spotting the Red Flags in Financing Agreements

Heads up: not all financing offers are created equal. Some are loaded with clauses designed to trip you up, turning a great deal into a financial nightmare. Your job is to become a savvy borrower who can spot these traps from a mile away.

Here are the biggest red flags to watch for:

- The "Deferred Interest" Clause: This is the most dangerous trap in 0% APR offers. If you fail to pay off the entire balance by the end of the promotional period—even by a single dollar—the lender can legally charge you all the interest that would have built up from day one. It’s a massive penalty that can add thousands to your total cost.

- Prepayment Penalties: Some lenders, especially with certain personal loans, will actually charge you a fee for paying off your loan early. This is a clear sign of a bad deal. You should always have the freedom to pay down debt faster without being punished for it.

- Vague or Overly Complex Terms: If the agreement is filled with confusing jargon or the fee structure is a mess, just walk away. Good lenders are transparent about their terms, fees, and penalties.

A trustworthy financing agreement is easy to understand. If you feel like you need a law degree to decipher the terms, that's a major red flag telling you to look elsewhere.

Actionable Tips to Boost Your Approval Chances

Beyond having your paperwork ready, you can take a few simple steps to make your application more attractive to lenders. These small moves can give your credit profile a nice bump and improve your odds of getting approved with the best terms.

Before you apply, try these moves:

- Check Your Credit Report for Errors: Mistakes happen. Get a free copy of your credit report from all three major bureaus (Equifax, Experian, and TransUnion) and dispute any inaccuracies you find.

- Pay Down Small Credit Card Balances: Lenders look closely at your credit utilization ratio—how much of your available credit you're using. Paying down small balances can lower this ratio and give your score a quick lift.

- Avoid New Credit Inquiries: Don't apply for other loans or credit cards right before you seek financing for the ring. A flurry of recent inquiries can make you look like a riskier borrower.

By following this checklist and staying vigilant, you put yourself in the driver's seat to secure a financing plan that is fair, transparent, and free of any unwelcome surprises.

Find Your Perfect Ring with a Plan That Fits

Choosing an engagement ring should be about celebrating your future, not worrying about the finances. The most important thing to remember is simple: the right plan helps you get a beautiful, high-quality ring without starting your new life together under a cloud of financial stress.

It’s all about finding that perfect balance where the payments feel manageable. That way, you can focus on the joy of the proposal and the life you're building. Ultimately, it’s a smart financial decision that honors both your relationship and your long-term goals.

The best engagement ring financing options don’t just help you buy a ring; they give you peace of mind. A thoughtful payment strategy is the final, crucial step in making this milestone moment as perfect as it should be.

At ECI Jewelers, our job isn't just to help you find the perfect diamond. We provide a pressure-free environment where you can explore clear, transparent financing solutions that work for your specific situation. Our team is here to walk you through every detail, ensuring you feel completely confident in your choice.

We invite you to schedule a virtual consultation or visit our NYC showroom to talk about both your dream ring and the payment strategy that makes the most sense. You can learn more about how to finance your ring with ECI Jewelers and take the next step with confidence. Let us be your trusted partner in making this moment as joyful and stress-free as possible.

Frequently Asked Questions About Ring Financing

When you're thinking about financing an engagement ring, a lot of questions can pop up. It's completely normal. We've gathered the most common ones we hear to give you clear, straightforward answers so you can move forward with total confidence.

Think of this as tying up the loose ends. Getting clarity on how financing affects your credit, paying it off early, and your options if your score isn't perfect ensures there are no surprises down the road.

Will Financing an Engagement Ring Hurt My Credit Score

Financing a ring will definitely have an impact on your credit score, but it's not automatically a bad thing. When you first apply for any kind of credit, the lender runs a hard inquiry, which can cause your score to dip by a few points temporarily. That’s standard.

The good news? Making your payments on time, every time, can actually build a positive credit history. Successfully paying off an installment loan or a credit card balance shows the credit bureaus you’re a responsible borrower. The one rule you absolutely must follow is to never, ever miss a payment—that's what can really do some damage.

Can I Pay Off My Financing Plan Early

Yes, and you absolutely should if you can! The vast majority of reputable financing plans—whether it’s a personal loan, a 0% APR credit card, or in-store financing—do not have prepayment penalties. This means you’re free to pay off the balance faster to save money on interest.

Always double-check that there is no prepayment penalty before you sign on the dotted line. Paying off a loan early is one of the smartest financial moves you can make, and you should never be penalized for it.

What Are the Best Options for Bad Credit

If your credit score has seen better days, your options are a bit more limited, but you're definitely not out of the game. You probably won't qualify for those prime 0% APR credit cards or the lowest-interest personal loans, but you still have solid paths forward.

Here’s what to look into:

- Layaway Plans: This is often the best route. You make steady payments over time with zero interest and no credit check. Once it’s paid off, the ring is yours. It’s a completely risk-free way to secure the ring you want.

- In-Store Financing: Some jewelers offer programs specifically for people with fair credit or those in the process of rebuilding. The interest rates will be higher, but it’s a direct path to getting the ring financed.

- A Significant Down Payment: Putting more money down from the start reduces the total amount you need to finance. This can make lenders much more comfortable approving your application, even with a lower score.

At ECI Jewelers, we believe finding the perfect ring should be a joyful experience, supported by a payment plan that brings you peace of mind. Explore our collection and discover flexible financing solutions designed to fit your life at https://www.ecijewelers.com.