Deciding how much to spend on an engagement ring is a genuinely personal choice. The best modern guideline? Spend what you can comfortably afford without sinking into serious debt. It’s time to forget those outdated rules. Today's average spend hovers around $6,800, but a truly meaningful budget is one that fits your financial reality and shared future—not one that tries to live up to some old-school expectation.

Debunking Old Myths and Setting a Modern Budget

For decades, you couldn't talk about engagement rings without someone bringing up the "two-month salary" rule. Thankfully, that idea, which was actually born from a clever marketing campaign decades ago, is finally fading away. Today, the conversation has shifted from arbitrary formulas to financial wellness and what the ring actually means to you.

The "right" amount is no longer a number dictated by your paycheck but a figure that reflects your unique life circumstances. This modern approach gets that every couple's financial journey is different. You might be saving for a house, paying down student loans, or planning a huge wedding. A thoughtful, well-planned budget for the ring is really the first step in building a solid financial future together. It should be a decision based on comfort and confidence, not pressure.

Finding Your Financial Comfort Zone

The key is to tune out the external noise and look at your own situation. While the national average engagement ring cost has climbed to about $6,800—a notable 12% jump from the previous year—this number is all over the map. For instance, in states like New York, the average can be as high as $9,400.

These numbers give you some context, but they shouldn't be your compass. Your budget is about what works for you. You can even learn more about how spending averages change by state to see the full picture.

The most meaningful engagement ring isn't the most expensive one. It's the one that symbolizes your commitment without compromising your shared financial goals for the future.

To help you frame your thinking and find a starting point, it can be helpful to look at a few modern budgeting philosophies. Instead of rigid rules, think of these as different ways to approach the same decision.

Here’s a quick breakdown of three popular methods people use today:

Three Modern Approaches to Engagement Ring Budgeting

| Budgeting Approach | Core Concept | Best For |

|---|---|---|

| The 1-Month Rule | A simplified guideline suggesting one month's take-home pay as a comfortable spending limit. | Couples who want a clear, simple starting point without creating financial strain. |

| The Financial Priority Plan | The ring budget is decided after factoring in savings, debt, and other major life goals. | Financially-savvy couples who prioritize long-term goals like buying a home. |

| The "What You Can Afford" Method | You set a budget based on what you already have saved or what you can save in a few months without taking on debt. | Anyone looking for a debt-free start to their engagement and marriage. |

Ultimately, whether you lean toward a one-month guideline or a more detailed financial plan, the goal is the same: choose a ring that feels right for your love story and your bank account. The best decision is one that leaves you both excited for the future, not stressed about the past.

Understanding the Average Engagement Ring Cost

Figuring out how much to spend on an engagement ring can feel like trying to hit a moving target. While national averages give you a ballpark idea, it's less about aiming for a specific number and more about understanding what those numbers actually get you.

Think of the average cost not as a hard rule, but as a landmark to get your bearings in the jewelry market. It shows you what’s typical, but your personal journey to find the perfect ring might take a completely different path.

Lately, we've seen spending on rings shift, often mirroring what's happening in the broader economy. Right now, the average engagement ring cost in the United States is $6,504, which is actually a slight dip from previous years. This is part of a bigger trend where over 60% of people are making more conscious spending decisions, especially on bigger purchases.

What Different Price Points Can Get You

To make these numbers feel real, let’s break down what you can expect at different budget levels. This isn't about boxing you into a category, but showing you the trade-offs and opportunities at each price point.

- Under $3,000: You can find an absolutely stunning and meaningful ring in this range by being strategic. Think about a brilliant lab-grown diamond, which gives you a much bigger stone for your money. Or, you could go for a unique gemstone like a sapphire or morganite as the star of the show.

- $3,000 to $7,000: For many couples, this is the sweet spot, falling right in line with the national average. A gorgeous one-carat natural diamond is well within reach here. You also get more flexibility with settings, from timeless solitaires to delicate pavé bands that add extra sparkle.

- Over $7,000: As the budget grows, so do your options for size, quality, and complexity. You can start looking at diamonds with higher clarity and color grades, explore more intricate settings with detailed metalwork, or simply go for a significantly larger center stone.

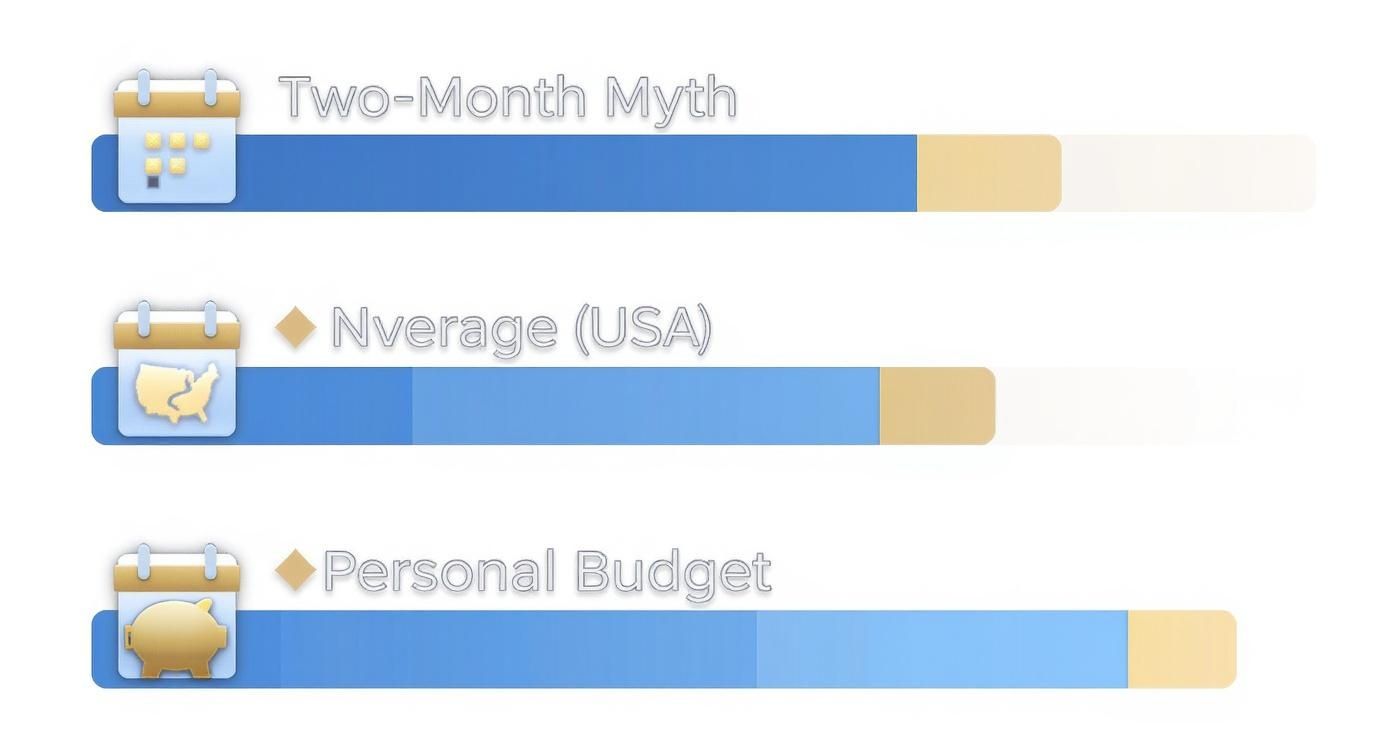

The infographic below really puts modern budgeting in perspective, especially when compared to those old, outdated "rules."

As you can see, that old two-month salary myth sets a pretty unrealistic goal for most people. A personal budget that feels right for you is always the most grounded and flexible approach.

The Rise of Lab-Grown Diamonds

One of the biggest game-changers in today’s market is the incredible popularity of lab-grown diamonds. These stones are physically, chemically, and visually identical to natural diamonds, but they often cost 30-50% less. For many couples, that price difference is massive.

Opting for a lab-grown diamond allows you to maximize your budget, often enabling you to afford a larger or higher-quality stone than you could with a natural diamond at the same price point.

This isn't about picking a "lesser" diamond; it's about making a smart financial choice that aligns with your priorities. For instance, a budget that gets you a 0.8-carat natural diamond could easily land you a brilliant 1.2-carat lab-grown stone. This choice gives you the power to focus on things like the overall size and brilliance—which are closely tied to its carat weight—without stretching your finances too thin.

What Actually Determines an Engagement Ring Price

When you look at an engagement ring, it’s easy to get lost in the sparkle, but the price tag can feel like a total mystery. What makes one ring cost $3,000 while another one that looks pretty similar is priced at $10,000? The answer is a blend of different factors, with the center stone—almost always a diamond—playing the starring role.

Getting a handle on these elements is your secret weapon for making smart trade-offs. It gives you the power to put your budget toward the features that truly matter to you and your partner, making sure you get the most beauty and value for your money. Let's break down the main components that drive the final cost.

The Four Cs of Diamond Quality

The quality and price of a diamond are universally graded by the “Four Cs”—Cut, Color, Clarity, and Carat weight. Think of these as the diamond's official report card. Mastering these concepts is the first step toward knowing exactly what you're paying for.

- Carat Weight: This is the most straightforward "C"—it’s simply a measure of the diamond's weight. A higher carat weight usually means a higher price, but two diamonds of the exact same weight can have wildly different costs because of the other three Cs.

- Cut: Often mistaken for the diamond's shape (like round or princess), the cut actually refers to how well its facets interact with light. A well-cut diamond acts like a perfect series of mirrors, capturing light and reflecting it back to create that jaw-dropping sparkle. In fact, an excellent cut can make a diamond appear larger and more brilliant than a poorly cut stone of a higher carat weight.

- Clarity: This grade measures the absence of internal flaws (called inclusions) and external blemishes. A "flawless" diamond is incredibly rare and carries a hefty price tag, but many inclusions are microscopic and totally invisible to the naked eye. You can often find a visually stunning diamond with a lower clarity grade and save a huge amount of money.

- Color: The color grade evaluates the lack of color in a white diamond. The scale runs from D (completely colorless) to Z (light yellow or brown). The differences between neighboring grades, like G and H, are often so subtle that only a trained gemologist can tell them apart.

A common mistake is prioritizing carat weight above everything else. A large, poorly cut diamond with visible flaws will have far less life and sparkle than a smaller, brilliantly cut diamond with good clarity.

For a deeper dive into these characteristics, our complete guide on diamond education can help you become an expert in no time. Understanding these details helps you decide what to prioritize when figuring out how much to spend on an engagement ring.

Beyond the Center Stone

While the diamond is the main event, it's not the only thing driving the price. The setting—the metal framework that holds the diamond—plays a huge role in both the ring's final look and its cost.

The choice of precious metal is a major component. Platinum is a popular, durable, and naturally white option, but it's also the most expensive because it’s so dense and rare. White gold offers a similar look for a lower price, while yellow and rose gold provide that classic or modern warmth.

The complexity of the setting itself also impacts the price. A simple solitaire band will be far more affordable than an intricate halo setting with dozens of tiny pavé diamonds, which require more metal and a whole lot more labor to create.

Finally, the jeweler or brand name can add a premium. Well-known luxury brands often have higher markups because of their reputation, marketing costs, and brand prestige. Working with a trusted local jeweler can often give you better value, allowing more of your budget to go directly into the quality of the diamond and the craftsmanship of the ring itself.

How to Create Your Smart Ring Budget

Knowing what makes a ring expensive is one thing. Turning that knowledge into a realistic, personal budget is where the real magic happens. This isn't just about picking a number out of thin air; it's about drawing a clear roadmap that actually fits your life.

Getting this right transforms a potentially stressful purchase into an empowering first step in your shared financial future. A smart budget brings clarity, cuts out the guesswork, and ensures this beautiful symbol of your love doesn't come with a side of financial stress.

Let's walk through exactly how to build a budget that works for you.

Assess Your Current Financial Health

Before you can even think about a number, you need an honest picture of where you stand today. Think of it as a quick, private financial check-up to ground your decision in reality, not just emotion. Being brutally honest with yourself here is the key to avoiding headaches later.

Take a hard look at these core areas:

- Your Income: What’s your consistent monthly take-home pay after all the taxes and deductions are gone?

- Your Savings: How much do you have stashed away? More importantly, what piece of that could you comfortably put towards a ring without wiping out your emergency fund?

- Your Expenses and Debts: List out your fixed monthly costs—rent or mortgage, car payments, student loans. Knowing what you owe every month shows you what you truly have left over to spend or save.

This exercise isn't meant to feel restrictive. It's about drawing a map. You wouldn't start a cross-country road trip without knowing your starting point, and the same logic applies here. This simple assessment will show you what you can realistically afford without derailing other big goals, like saving for a house.

Have an Open Conversation with Your Partner

While the proposal itself can be a total surprise, the money side of things really doesn't have to be. Talking about the ring budget with your partner is becoming more and more common, and for good reason. It’s a major purchase, and honestly, it's great practice for the kind of open financial talks that build a rock-solid marriage.

This conversation isn't about ruining the romance. It's about teamwork and ensuring the ring reflects your shared values and financial priorities as a couple.

A great way to start is by framing the conversation around your long-term goals. Talk about the future you're building together—travel, buying a home, starting a family. From there, you can figure out together how the engagement ring fits into that bigger picture.

You might be surprised by what your partner truly values. It could be a specific, meaningful style rather than a massive diamond, which could totally change your budget. This kind of teamwork ensures you're both genuinely excited about the decision you make together.

Navigating Payment and Financing Options

Once you’ve got a smart budget figured out, the next step is deciding how you’re actually going to pay for the ring. This choice is just as important as the number itself because it can affect your finances for years to come. Getting the payment strategy right means you can keep your focus where it belongs: on the joy of the proposal, not on a pile of looming debt.

The most straightforward way to buy an engagement ring is with cash you’ve already saved. This approach is clean and simple, guaranteeing you start your new chapter completely debt-free. It’s a great feeling to know the ring is truly yours from day one.

Of course, many people use a credit card, which can be a savvy move if you play your cards right. Using a card with a great rewards program—think airline miles or cash back—can add a little extra value to your purchase. The golden rule here is to pay off the entire balance immediately. The last thing you want is high interest rates that can quickly inflate the ring's total cost.

Understanding Financing and Loans

For those who need a bit more flexibility, plenty of jewelers offer specialized financing plans. These can be fantastic tools, especially when you find a promotional 0% APR offer. This lets you break up the cost over a set period without paying a dime in interest.

Before you sign on the dotted line, you have to read the fine print. Look for hidden fees, understand what happens if a payment is late, and know exactly what the interest rate will jump to after the promotional period ends. To make financing work for you, it’s crucial to have a solid plan to pay off the balance before that date. If you're considering this route, you should explore a jeweler's specific financing options to get clear on the terms.

A 0% APR financing offer is only a good deal if you can pay off the entire balance before the promotional period expires. Otherwise, deferred interest can wipe out any initial savings.

Another path is a personal loan from your bank or a credit union. These loans usually have a fixed interest rate and a set repayment schedule, which makes your payments more predictable than a credit card. The rates are often lower than standard credit card APRs, but getting a good rate really depends on your credit score.

So, how do you choose? It’s all about weighing the pros and cons against your personal financial situation:

| Payment Method | Key Advantage | Main Consideration |

|---|---|---|

| Cash/Savings | Completely debt-free; no interest costs. | Requires having the full amount available upfront. |

| Credit Card | Potential for valuable rewards (miles, cash back). | High interest rates if the balance isn't paid off immediately. |

| Jeweler Financing | Access to 0% APR promotional periods. | Risk of high deferred interest if not paid off in time. |

| Personal Loan | Fixed interest rate and predictable payments. | Requires a good credit score for a favorable rate. |

Ultimately, the best payment method is the one that fits your budget and won't add unnecessary financial stress. By thinking through each path, you can make a confident choice that honors both your commitment and your long-term financial health.

Common Engagement Ring Budgeting Questions

Even with a budget in place and a good handle on payment options, some questions usually linger. Getting those last few uncertainties cleared up can give you the final shot of confidence you need before pulling the trigger. Think of this as your quick guide to those final details.

We’ll give you straightforward answers to the most common questions we hear, helping you feel totally prepared.

Is the Two-Month Salary Rule Still a Thing?

Absolutely not. The whole “two-month salary” rule is a ghost of marketing past, a concept cooked up decades ago. These days, the conversation has completely shifted to what makes sense for your personal finances and your goals as a couple.

The best approach? Spend an amount that feels right and doesn’t add financial stress or get in the way of other things you want to achieve together.

How Can I Save Money Without Sacrificing Quality?

Getting the most for your money is all about making smart trade-offs. You don't have to compromise on a beautiful ring—you just need to know where your dollars have the most impact.

- Consider a lab-grown diamond: These are physically and chemically identical to natural diamonds. You get the same sparkle and brilliance, but often for 30-50% less.

- Prioritize the diamond’s cut: A well-cut diamond will out-sparkle a poorly cut one every single time, making it look bigger, brighter, and more expensive than it is.

- Choose a different metal: Platinum is fantastic, but 14k gold gives you a nearly identical look for a much friendlier price tag.

These simple moves can make your budget go way further, letting you focus on the stuff that creates that "wow" factor.

The most common and impactful way to save money is by prioritizing the diamond's 'Cut' grade above all else. An excellent cut can make a diamond with lower color or clarity grades look absolutely stunning to the naked eye.

Should My Partner and I Discuss the Budget Together?

Yes, it’s a fantastic idea. While the proposal itself should be a surprise, talking about the budget beforehand is an incredibly healthy—and common—practice. An engagement ring is a major financial decision, and having that conversation is great practice for the kind of financial teamwork that makes a strong marriage.

This talk ensures the ring reflects your shared values and stops any potential money stress before it starts. It’s about being a team, not about spoiling the surprise.

Does the Average Ring Cost Vary by Location?

It certainly does. You'll almost always see a higher average spend in big cities with a higher cost of living, like New York or Los Angeles. But remember, those numbers are just statistics—they are not rules.

Your personal budget should always be your North Star, no matter what the regional averages say. The right price is what works for your wallet, not what works for your zip code.

At ECI Jewelers, we believe finding the perfect engagement ring should be an exciting and confident experience. Our experts are ready to guide you through every step, helping you find a breathtaking ring that honors your love story and respects your budget. Explore our stunning collection of diamond engagement rings and discover the quality and value that has made us a trusted New York jeweler for over 25 years.

Find your perfect ring today at ECI Jewelers.