Selling a luxury watch can feel like a big undertaking, but it’s actually a pretty straightforward process when you have a solid game plan. At its core, it's about gathering your original documents, getting a real-world valuation from a professional, picking a trusted sales channel, and making sure the final transaction is secure.

This approach ensures you know exactly what your watch is worth and helps you connect with reputable buyers who will pay a fair price.

Your Roadmap to a Successful Watch Sale

Whether you’re parting with a Rolex, Patek Philippe, or Audemars Piguet, having a clear plan makes all the difference. Think of this as your roadmap to navigating the sale with confidence, from the initial assessment all the way to getting paid.

The process actually starts long before you even think about listing the watch. It begins with getting all your ducks in a row.

The most critical first step? Rounding up the original "box and papers." This includes the warranty card, the original purchase receipt, and any service records you've kept. These documents are proof of authenticity and provenance, and they immediately boost your watch's value and appeal to serious collectors and dealers. A watch with its complete set will always sell for more—and faster—than one without.

Getting a Feel for the Market

The pre-owned watch market is always moving, and knowing the current trends is key to getting a great price. According to Chrono24's Secondary Watch Market Report for H1 2025, the secondary market is absolutely booming.

Consider this: Rolex alone commands a massive 33.7% market share of all spending on the platform. That means nearly one out of every three dollars spent goes to models like the Submariner or Daytona, highlighting the incredible demand for certain brands.

Working with a trusted buyer like ECI Jewelers right here in New York City’s Diamond District helps you tap into that demand directly. An expert can give you a free, market-based valuation and often provide same-day payment. This route lets you skip the hefty 10-15% commission fees that auction houses typically charge.

A well-documented watch doesn't just fetch a higher price; it sells faster. Buyers are paying for confidence and history just as much as they are for the timepiece itself.

Before you even ask for an offer, take a moment to assess your watch's condition honestly. Make a note of any scratches, dings, or signs of wear on the case, bracelet, and crystal. This kind of transparency builds trust with potential buyers and ensures the valuation process is smooth and accurate—it's exactly what reputable dealers like us look for.

Your Pre-Sale Checklist for a Higher Offer

Before you take another step, gathering the right items and information will set you up for a smooth sale and a much better offer. Think of this as your prep work.

| Item/Action | Why It's Important | Potential Value Increase |

|---|---|---|

| Original Box | Shows the watch was well-kept and adds to the "complete set" appeal for collectors. | 5-10% |

| Warranty Card/Papers | The single most important proof of authenticity and original purchase date. | 10-20% |

| Purchase & Service Receipts | Documents the watch's history, ownership, and maintenance, building buyer trust. | 3-5% |

| Extra Links | Ensures the bracelet can be sized for any wrist, avoiding a common buyer objection. | Up to $500+ (depending on model) |

| Honest Condition Assessment | Noting scratches/dings upfront prevents surprises and speeds up the final offer. | Builds trust; avoids price reduction |

| High-Quality Photos | Clear, detailed photos attract serious buyers and showcase the watch's true condition. | Faster sale, stronger offers |

Having these items ready not only makes the process easier but also signals to buyers that you're a serious and meticulous owner, which almost always translates to a better price.

Preparing Your Watch to Maximize Value

First impressions are everything, especially when you’re selling a luxury watch. How your timepiece looks and the story it tells through its paperwork can make a massive difference in the offers you get. This prep phase is your chance to frame your watch in the best possible light, making sure its history and condition are fully appreciated.

Think of it like staging a home before putting it on the market. A few smart moves now will make your watch far more desirable, build serious buyer confidence, and speed up the entire appraisal and sale process.

The Power of a Full Set

In the world of pre-owned watches, you’ll hear the term "full set" or "box and papers" constantly. It’s the holy grail for collectors and dealers. This just means having all the original goodies that came with the watch when it was brand new. Assembling these is the single best thing you can do to boost its value.

Here’s what a typical full set includes:

- Original Presentation Box: Both the inner and outer boxes show the watch was cared for and stored correctly.

- Warranty Card/Certificate of Authenticity: This is the watch's birth certificate, locking in its serial number and original sale date.

- Instruction Manuals and Booklets: These might seem minor, but they complete the original package that collectors crave.

- Hang Tags and Bezel Protectors: Tiny details like the original chronometer tag or plastic bezel guard are huge wins for serious buyers.

- Purchase and Service Receipts: A documented service history from authorized centers is proof of proper maintenance and adds a thick layer of trust.

Having these items doesn't just prove authenticity—it tells the story of a well-loved timepiece. Before you do anything else, get your documents in order. You can even use a certificate verification service to double-check that everything is legit, which gives buyers total peace of mind.

Safe Cleaning for a Flawless Presentation

You don't need to pay for a professional detailing to get your watch looking sharp, but you absolutely must be careful. The goal here is to remove surface grime, not to polish away its history. In fact, aggressive polishing can tank a watch's value, as collectors often pay more for the original, untouched factory finish.

For a safe at-home cleaning:

- Grab a soft, dry microfiber cloth and give the entire watch a gentle wipe-down to get rid of fingerprints and dust.

- For a deeper clean, find a very soft-bristled toothbrush (a baby toothbrush is perfect) and use a tiny drop of mild soap with lukewarm water.

- Gently scrub the bracelet and case. Pay special attention to the gunk that builds up between the links.

- Rinse it quickly under lukewarm water, then immediately dry it thoroughly with a clean microfiber cloth.

Crucial Tip: If your watch isn't water-resistant or you have any doubt about its seals, skip the water completely. A dry cloth is your only tool. Never, ever submerge a watch unless you're 100% certain about its water resistance rating and recent service history.

How Documentation Translates to Dollars

I can't overstate the importance of paperwork. A watch's value rests on two pillars: authenticity and condition. And the market data doesn't lie—verified pieces with complete documentation consistently fetch premium prices.

Recent data shows that having the original papers can boost a watch's value by 15-30%. For instance, a 2022 Rolex Submariner with its full set might sell for around $18,000. The exact same watch without its papers? It could struggle to get more than $15,000. That’s a $3,000 difference just for keeping a few documents safe.

This is why sellers benefit from working with experts like ECI Jewelers. With over 25 years of experience inspecting everything from Rolex to Panerai, we see firsthand how much these details matter. Taking the time to prep your watch and its paperwork is a direct investment in the price you’ll get. It builds the trust and transparency that every serious buyer is looking for.

Where to Sell Your Watch for the Best Results

So, your watch is prepped, you've gathered its story, and now you’ve hit the most critical fork in the road: where do you actually sell it? The path you choose here directly affects your final payout, how quickly you get paid, and your peace of mind.

It can feel like a maze of options, but it’s actually pretty straightforward once you understand the real-world trade-offs. We’ll walk through the four main routes: trusted dealers, online marketplaces, auction houses, and private sales. By the end, you'll know exactly which one fits your watch and your goals.

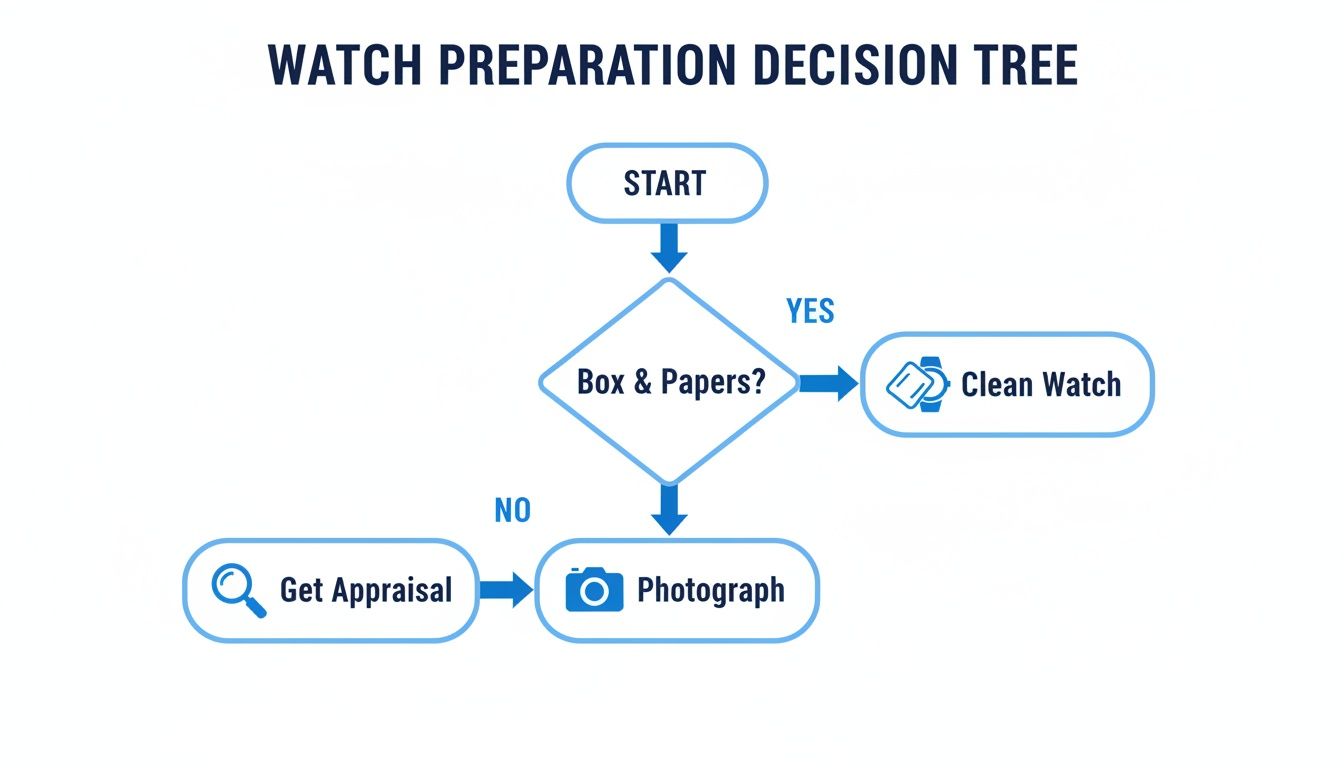

This quick decision tree helps visualize the first few steps before you even think about where to sell.

As you can see, having the original box and papers streamlines everything. Without them, getting a formal appraisal is your first move to lock down its authenticity and value.

Selling to a Trusted Dealer

For most people, working with a reputable dealer like ECI Jewelers is the safest, fastest, and most straightforward option. You're trading a small amount off the absolute top-end price for zero headaches and immediate payment. It's a transaction built on expertise and efficiency.

Instead of listing your watch and waiting for a buyer to appear, a dealer makes you a direct, outright offer. You can walk in (or ship your watch, fully insured) and get a professional, market-based valuation on the spot. If you like the number, you get paid right away via check or wire transfer. Simple.

The upsides are obvious:

- Speed: The whole process, from appraisal to cash-in-hand, can happen the same day.

- Security: You're dealing with a legitimate business that has a physical storefront and a public reputation on the line. No sketchy meetups.

- Convenience: Forget about taking photos, writing descriptions, answering endless questions from strangers, or figuring out insured shipping. It’s all handled for you.

Online sales are booming, and Persistence Market Research predicts they will grab 29.3% of the entire luxury watch market by 2025, topping $6 billion. This massive shift favors secure, expert-verified platforms—exactly what a trusted dealer offers. Sellers who go this route completely avoid the drama of peer-to-peer sales, where industry data shows a staggering 25% of deals end in a dispute over the watch's condition.

Selling to a dealer is the fastest way to turn your watch into cash. You trade a small percentage of the absolute highest possible price for immediate payment and zero risk. For many sellers, this peace of mind is invaluable.

Navigating Online Marketplaces

Platforms like Chrono24 or eBay can get your watch in front of a huge global audience, which sounds great on paper. But in reality, this route puts all the work—and all the risk—directly on your shoulders. You instantly become the photographer, marketer, customer service rep, and shipping expert.

While you might squeeze out a higher final price, the journey is often littered with problems. You have to field an army of lowball offers, vet potential buyers for scams, and then hand over a hefty commission fee, which can run anywhere from 6.5% to over 12%. You’re also on the hook for managing complex insured shipping and dealing with potential returns.

Considering Auction Houses

If you happen to own an incredibly rare, historically significant, or six-figure-plus timepiece, a major auction house like Phillips or Sotheby's might be the way to go. They have the connections to market truly unique watches to elite collectors around the world, which can sometimes lead to a record-setting price.

But let's be clear: this isn't the right choice for 99% of luxury watches. The process is painfully slow, often taking six months or more from the time you consign the watch until you see any money. Plus, the fees are substantial. Between the seller's commission and other charges, you can expect 15-25% of the final hammer price to be eaten up.

The Risks of a Private Sale

Selling your watch directly to another person—maybe through a forum or a Facebook group—can theoretically net you the most money. There are no middlemen and no commissions. But this path is, by far, the most dangerous.

You are responsible for everything, from figuring out if the buyer is legitimate to arranging a secure place for the exchange. The potential for scams, counterfeit cash, or even robbery is incredibly high. Unless you’re a seasoned seller with a network you trust implicitly, the extra cash just isn't worth the personal risk.

To help you decide, here’s a quick head-to-head comparison of your options.

Comparing Your Watch Selling Options

| Sales Channel | Pros | Cons | Best For |

|---|---|---|---|

| Trusted Dealer | Fast, secure, convenient, immediate payment | Payout is slightly less than top retail market value | Sellers prioritizing safety, speed, and a hassle-free experience. |

| Online Marketplace | Huge audience, potentially higher selling price | High fees, time-consuming, risk of scams and returns | Experienced sellers comfortable with managing the entire sales process. |

| Auction House | Access to elite collectors, potential for record prices | Extremely slow, very high commissions (15-25%+), selective | Extremely rare, high-value, or historically significant timepieces. |

| Private Sale | No commission fees, potentially highest net return | Highest risk of theft, scams, and payment fraud | Experts with a trusted personal network. Not for beginners. |

Ultimately, the best channel depends entirely on your priorities. If you value your time and security above all else, a trusted dealer is almost always the right call. For a transparent, secure, and professional experience, you can explore selling your luxury watch directly to a trusted buyer.

Understanding What Your Watch Is Really Worth

Getting the price right is everything when you sell a luxury watch. It's the make-or-break step. Go too high, and you'll hear crickets from serious buyers. Price it too low, and you're just leaving cash on the table. Finding that sweet spot is a delicate art that has almost nothing to do with what you originally paid.

Think of the pre-owned watch market as a living, breathing thing. It's constantly shifting based on supply, demand, and what collectors are buzzing about. A watch's value isn't a fixed number; it moves with trends and is defined by the tiny details that separate a decent example from a truly great one.

The Key Drivers of Watch Value

So, what actually determines what someone will pay for your watch today? It's never just one thing. It’s a blend of brand power, scarcity, condition, and how complete the package is.

- Brand Reputation and Model Demand: Let's be honest, names like Rolex, Patek Philippe, and Audemars Piguet carry immense weight. That brand equity sets a high floor for value. Within those brands, certain models are pure "hype." A steel Rolex GMT-Master II "Pepsi," for instance, consistently trades for thousands over its retail price simply because everyone wants one.

- Rarity and Reference: Are we talking about a standard production model or a special edition? Discontinued references, funky dial configurations, or short production runs can make a watch exponentially more valuable to the right collector.

- Physical Condition: This is huge. Deep scratches, dings in the case, or a chipped crystal will immediately drag the price down. On the flip side, a watch in pristine, unpolished condition with sharp, factory-fresh case lines is what everyone is hunting for.

- Provenance and the "Full Set": As mentioned before, having the original box, warranty card, hang tags, and manuals is non-negotiable for maximizing value. This "full set" is the watch's birth certificate and service record rolled into one, often boosting its worth by 15-30%.

Your watch's value is a story told by its brand, condition, rarity, and documentation. An online calculator can only guess the plot; a professional appraiser reads the entire book.

For older timepieces, these details become even more vital. If you're holding a unique historical piece, a specialized guide to vintage pocket watch value and worth can shed light on how age and historical context play into an appraisal. The core principles, however, remain the same.

Why Online Calculators Fall Short

You've probably seen them: the dozens of "what's my watch worth" websites. They can give you a rough, back-of-the-napkin number, but they are fundamentally limited. These tools scrape old sales data or use generic formulas that completely miss the nuances of your specific watch.

An algorithm can't spot the gorgeous, even patina on a vintage Submariner dial that might add thousands to its price. It can’t tell if the case has been over-polished, destroying its original lines and subtracting value. And it certainly can't keep up with the market's mood swings. The recent correction, where models like the Daytona dropped 30-50% from their 2022 highs, proves just how fast online estimates become useless.

The Necessity of a Professional Valuation

This is where you need an expert in your corner. Getting a professional, market-based valuation from a specialist like ECI Jewelers is the only way to know what your watch is truly worth in today's market. A pro doesn't use a simple formula; they bring years of hands-on experience and access to real-time sales data from a global network.

Here’s what an expert sees that an online tool can't:

- Micro-Condition Assessment: They’ll put your watch under a loupe, inspecting the sharpness of the lugs, the condition of the dial and hands, and the originality of every single part.

- Live Market Data: Reputable dealers are in the market every single day. They know what a specific reference is trading for this week, not six months ago.

- Nuance and Subtleties: They can identify a rare "spider" dial, a "tropical" patina, or other quirky features that can dramatically change the value.

This hands-on approach gives you a transparent, fair offer based on what a real buyer would actually pay for your watch, right now. To move forward with confidence, you need to learn more about how much your watch is worth from a trusted professional. It's the critical first step to a successful sale.

Completing the Sale Securely and Confidently

You’ve got an offer you’re happy with—now for the most critical part of the whole process. Getting the sale over the finish line is all about locking in your value while eliminating every possible risk. Each step from here on, from finalizing the price to payment and shipping, demands precision to ensure a smooth, secure transaction.

This is where the trust and established procedures of an expert dealer become priceless. Trying to navigate these final steps alone can be incredibly stressful, but a professional buyer has a bulletproof process designed to protect both you and them.

Smart Negotiation and Finalizing the Price

A little back-and-forth is a natural part of any significant sale. When you get an offer from a reputable buyer like ECI Jewelers, it’s not a number pulled from thin air. It’s a data-driven valuation based on a thorough, expert assessment of your watch's condition, completeness, and real-time market demand.

Still, there’s always room for a professional conversation. Here are a few tips for handling this stage with confidence:

- Be Informed: Go into the discussion already knowing your watch’s market value. Doing your homework shows you’re a serious and knowledgeable seller.

- Stay Realistic: Remember, a dealer's offer has to account for their overhead, any potential servicing costs, and a margin for resale. The offer will reflect fair market value, not the peak retail price you might see online.

- Focus on Facts: Base any counter-discussion on tangible points, like your watch’s pristine condition or its complete box-and-papers set, not on sentimental value.

Once you agree on a price, get it in writing. A formal purchase offer or a simple confirmation email creates a clear record and prevents any "misunderstandings" down the line.

Secure Payment: The Only Options to Trust

How you get paid is a non-negotiable part of your security. For a luxury watch sale, forget about cash or peer-to-peer apps like Venmo or Zelle. They offer zero fraud protection for high-value items and are a favorite tool of scammers.

There are only a few payment methods you should ever consider:

- Bank Wire Transfer: This is the gold standard for large, secure payments. The money moves directly from the buyer's bank to yours and is irreversible once it has cleared.

- Certified Bank Check: Issued directly by a bank, this guarantees the funds are available. When you're dealing with an established business, this is a very safe option.

- In-Person at a Trusted Dealer: Selling to a brick-and-mortar store like ECI Jewelers means you can get paid immediately and securely by check or wire transfer in a professional setting.

Never, ever hand over your watch until the funds are fully cleared and confirmed in your account. A "pending" wire or a personal check is not the same as a secured payment. Patience at this stage is your single best defense against fraud.

Insured Shipping: A High-Value Necessity

If you're selling your watch to a remote buyer, shipping is a critical point of risk. You can't just drop a Rolex in a standard box and hope for the best. Proper shipping requires meticulous packing and, most importantly, rock-solid insurance.

Start by packing the watch carefully. Use a small, sturdy box for the watch itself, cushioning it with bubble wrap or foam. Then, place that smaller box inside a larger, plain shipping box filled with more packing material. This double-boxing method protects against shocks and helps conceal the valuable nature of the contents.

Most importantly, you must use a carrier that lets you fully insure the package for its agreed-upon value. Services like FedEx and UPS offer declared value coverage, but you have to follow their packaging rules to the letter. This is another area where dealers shine—many, including ECI Jewelers, will provide you with a pre-paid, fully insured shipping label, taking all the guesswork and risk off your shoulders.

You can discover more about how the experts handle these logistics and learn where to sell luxury watches safely and professionally. This simple step can turn a nerve-wracking process into a secure, straightforward end to your sale.

Common Questions About Selling a Luxury Watch

Selling a high-end watch, especially for the first time, brings up a lot of questions. We get it. You want to make sure you're getting a fair deal and not making any rookie mistakes.

Think of this as the practical advice we give our own clients. Here are the clear, straightforward answers to the most common questions that come up.

Should I Service My Watch Before Selling It?

This is the big one, and our answer is almost always no. While a professional cleaning to remove grime is a smart move, a full mechanical service is a different story.

These services get expensive fast—often running hundreds or even thousands of dollars. The hard truth is you're very unlikely to recoup that cost in the final sale price.

A reputable buyer like ECI Jewelers has expert in-house watchmakers ready to handle any necessary servicing. We assess the watch's mechanical condition and simply factor any required maintenance into our offer. This saves you a major upfront expense and a lot of hassle.

Here's what really matters:

- Be honest. Is the watch running a little slow? Is the date function sticky? Just say so. Transparency builds trust and makes the whole process smoother.

- Never polish the case. Seriously. Most collectors and experienced buyers want a watch in its original, unpolished condition. The fine scratches and faint marks are part of its authentic story. A heavy-handed polish can soften the sharp, original lines of the case and actually lower its value.

How Much Value Do I Lose Without Box and Papers?

Losing the original box and papers happens all the time, but it definitely impacts the value. There's no single formula, but as a general rule, a watch without its "full set" can be worth 15-30% less than an identical piece with everything included.

The warranty card is like the watch's birth certificate—it confirms the serial number, model, and original sale date, which is the gold standard for proving authenticity. The box and other goodies add to the collectibility and show the piece was well-kept.

You can absolutely sell a "naked" watch (one without its kit), but you'll always get a stronger offer and attract more serious buyers when you have the complete package.

A watch with its full set tells a complete story of authenticity and care. Its absence isn't a deal-breaker, but it means a buyer has to factor in a higher level of risk and a lower degree of collectibility—and that's always reflected in the price.

What Are the Biggest Mistakes Watch Sellers Make?

After years in this business, we've seen it all. The good news is that the most common mistakes are also the easiest to avoid once you know what they are.

Here are the missteps we see most often:

- Unrealistic Price Expectations: It's easy to look at retail prices or sky-high online listings and get your hopes up. But the pre-owned market has its own logic. A professional, market-based valuation is the only way to know what your watch is actually worth today.

- Terrible Photos: Dark, blurry, or out-of-focus pictures do your watch a huge injustice. They hide its true condition and can make potential buyers think you're hiding something.

- Dealing with Unvetted Private Buyers: Selling privately can feel tempting, but it opens the door to a world of lowballers, time-wasters, and outright scams. That risk is rarely worth the small potential upside.

- Forgetting All the Paperwork: It’s not just about the warranty card. Old service records, the original purchase receipt, and even the little hang tags all build your watch’s provenance and can help nudge that final offer higher.

Is Trading My Watch a Better Option Than Selling?

It can be a fantastic move, especially if you have your eye on an upgrade or just want something new for your collection. Trading your current watch toward another timepiece is a great strategy that often gives you more value than a straight cash sale.

Why? Because reputable dealers like ECI Jewelers will frequently offer a higher credit value for a trade-in compared to a direct cash offer. It’s a win-win: you get more bang for your buck, and the transaction keeps a great watch within the dealer's inventory.

It's the cleanest way to move from, say, an Omega Seamaster to a Rolex Submariner in one simple, secure, and financially smart transaction.

Ready to take the next step with confidence? The team at ECI Jewelers offers a transparent, professional, and secure process for selling or trading your luxury watch. Get a free, no-obligation market valuation from our experts today. Visit us online to learn more.